Our Thoughts on the Recent Moody's Downgrade of the U.S. Government and the Market's Reaction

May 27, 2025

On May 16, Moody’s Investors Service, Inc (Moody’s) downgraded the long-term issuer rating on the Government of the United States of America by one notch to Aa1 from Aaa while changing the outlook to “stable” from “negative.” The downgrade resolves the negative outlook assigned by the agency in November 2023.

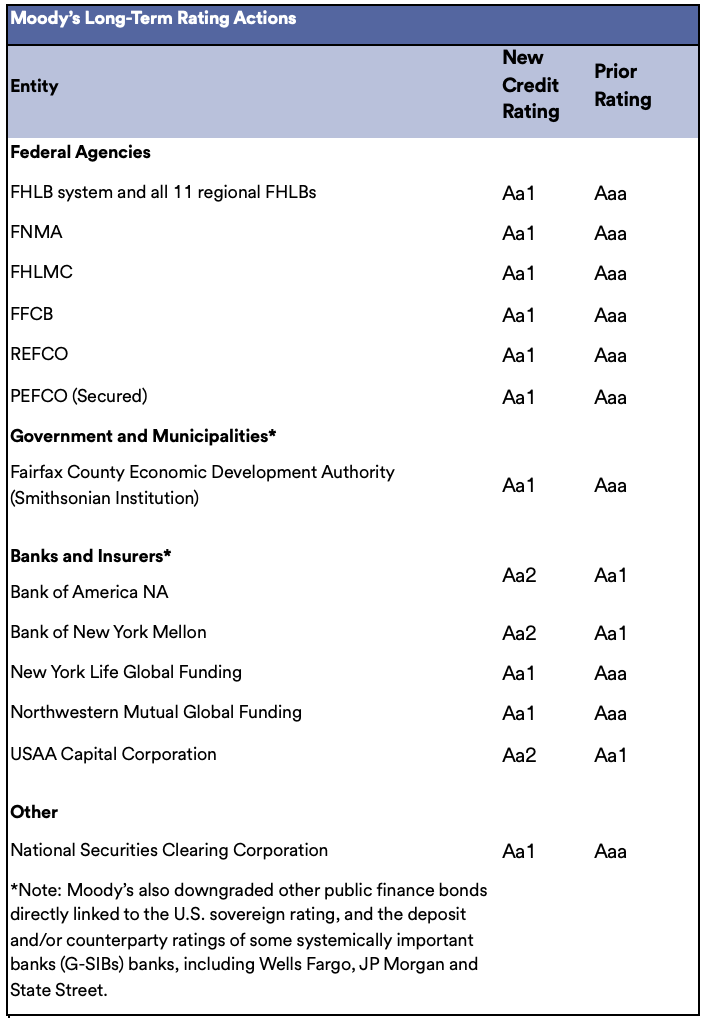

Moody’s subsequently downgraded all government-sponsored enterprises (GSEs) by one notch, including the Federal Farm Credit Bank System (FFCB), the Federal Home Loan Banks (FHLBs), the Federal National Mortgage Association (Fannie Mae), and the Federal Home Loan Mortgage Corporation (Freddie Mac). Lastly, Moody’s downgraded several highly rated financial issuers whose ratings were implicitly supported by the United States’ Aaa rating or had a strong credit linkage to the U.S. government. These financial institutions benefitted from 1-notch of ratings uplift based on the U.S. government’s credit rating of Aaa. When the U.S. was downgraded to Aa1, the ratings uplift was constrained and the result was that some of the ratings of these financial issuers were also downgraded. A summary of all downgrades is provided [below].

Rationale For Downgrade

In its report available (available here), Moody’s cited the United States’ large annual fiscal deficits which have led to increases in government debt and interest payment ratios to levels significantly above those of Aaa-rated peers. Additionally, Moody’s noted the United States has high deficit-to-gross domestic product (GDP) and debt-to-GDP ratios that are expected to rise further due to increased interest payments on debt, rising entitlement spending, and relatively low new revenue generation. Moody’s anticipates that an extension of the 2017 Tax Cuts as proposed in the current House Budget Reconciliation bill will add an additional $4 trillion to the federal fiscal deficit over the next decade, with the federal interest burden rising to approximately 30% of revenue by 2035 from 18% in 2024.

In assigning its stable outlook on the United States’ rating, Moody’s noted the exceptional credit strengths of the United States such as the size, resilience and dynamism of its economy and the role of the U.S. dollar as the global reserve currency. Moody’s also noted the importance of the Federal Reserve’s independence, constitutional separation of powers between the three branches of government, and respect for the rule of law as supporting the United States’ credit strength and resilience.

Market Reaction and Strategy Implications

The downgrade is the latest reminder of the continued deteriorating debt situation within the United States and is noteworthy within the context of ongoing policy, tariff and budget negotiations. We share the view that the current fiscal trajectory is problematic and unsustainable over the longer-term. Considering that Moody’s was a laggard relative to Fitch and S&P, the ratings action was not unexpected, and the timing was consistent with Moody’s typical 12- to 18-month window to complete its outlook review.

The market reaction so far has been relatively mild because Moody’s was the last rating agency to downgrade the United States, and the action was viewed as mostly symbolic in nature. While credit rating downgrades frequently pressure yields higher, bond market investors today are more focused on the implications of ongoing budget negotiations, the ultimate impact of tariffs on trade flows, inflation and economic growth, and the potential impact on the demand for U.S. dollar-denominated assets like Treasuries.

We expect the dollar to remain the world’s reserve currency and Treasuries to remain a safe and highly-liquid investment for domestic and foreign investors. In addition, the coincident downgrades do not materially change our view of investment in federal agencies or the affected highly rated banks, insurers or municipal issuers. Our focus remains on the larger macro-economic environment, and as such, we do not anticipate any changes to our investment strategy or approach because of the U.S. downgrade.

Source: Moody's

Sources