Quarterly Portfolio Manager Commentary

March 31, 2025

Cash Management Portfolios

What market conditions had a direct impact on the bond market this quarter?

Economic Activity – Following a strong 2024, U.S. economic growth slowed throughout the first quarter of 2025 (Q1) as consumer and business sentiment weakened sharply amid the disjointed rollout of new policies by the Trump administration. U.S. Gross Domestic Product (GDP) is projected to grow near 0.5% for Q1 and remain subdued over the balance of the year as rapidly changing tariff policies and escalating trade tensions weigh on growth prospects. Personal consumption eased from the robust pace in 2024, but the sharp deterioration in sentiment has yet to flow-through to actual spending levels, with consumers continuing to benefit from growing real wages and still-high household wealth. Labor markets remain resilient, with hiring activity keeping pace with labor force growth and layoffs remaining low. February U.S. job openings declined to 7.6 million open positions, while total unemployed workers in the labor force as of March were marginally higher at 7.1 million. Monthly Non-farm Payrolls (NFP) growth continues to ease but remains healthy, averaging 152,000 during Q1 and the U3 Unemployment Rate was 4.2% in March. Average Hourly Earnings growth is off its highs but remains solid at 3.8% year-over-year (YoY). U.S. inflation readings remained above the Federal Reserve’s (Fed) 2% target in Q1 but showed positive progress late in the quarter. The Consumer Price Index (CPI) declined to 2.4% in March versus 2.9% in December, reflecting a sharp drop in energy prices. Core inflation also improved with CPI ex. food and energy rising 2.8% YoY for March as core services prices gradually ease. The Fed’s preferred inflation index – the PCE Core Deflator Index – increased 2.8% YoY for February. The path back to the Fed’s inflation target remains elusive as goods inflation, which had detracted from inflation, is projected to be a headwind given the expected impact of tariffs on goods prices.

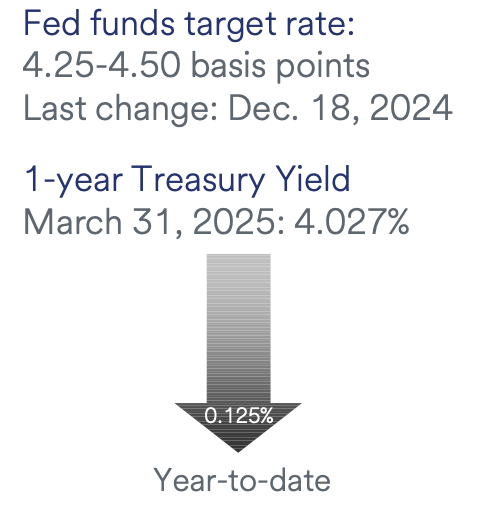

Monetary Policy – The Fed left its federal funds target range unchanged during the quarter at 4.25% to 4.50%. The Fed’s post-meeting statement was updated to remove reference to risks being roughly in balance and instead stated that “uncertainty around the economic outlook has increased." While Fed Chair Powell said no signal was meant by the change and noted economic data had not reflected the impact of tariffs, risks for weaker employment and higher inflation have increased in light of recent tariff announcements. The Fed slowed the pace of its balance sheet reduction program (quantitative tightening), with the monthly cap on Treasury securities lowered from $25 billion to $5 billion. The monthly cap on agency mortgage-backed securities was left unchanged at $35 billion, however, this is non-binding as monthly principal payments have yet to reach this level.

The Federal Open Market Committee (FOMC) released its updated Summary of Economic Projections at the March meeting, which continue to suggest 50 basis points (bps) of rate cuts in 2025 with the median projection for the federal funds rate in a range of 3.75% to 4.0% at year-end. The median dots show further rate cuts of 50 bps in 2026 and 25 bps in 2027, and the estimated longer-run neutral rate was unchanged at 3.0%. The FOMC’s economic projections were revised to show higher expected core inflation (2.8% versus 2.5%) and unemployment rate (4.4% versus 4.3%) in 2025 and a lower GDP growth forecast for 2025-2027 compared to the prior release.

Fiscal Policy – Q1 saw a whirlwind of fiscal policy action. The federal government once again narrowly avoided a shutdown in March with Congress passing a continuing resolution to fund government operations at existing spending levels through September. Congress is preparing legislation to permanently extend the 2017 tax cuts while providing additional tax cuts. Legislation will also address added spending for defense, immigration, and border control, raising the debt limit by as much as $4 to $5 trillion, and identifying spending cuts to fund a portion of the tax cuts. Legislation is expected to come sometime in May. At this point, no legislation has been passed raising the federal debt ceiling limit which is expected to be reached in the third quarter.

The quarter was highlighted by a flurry of tariff announcements culminating with “Liberation Day” on April 2 which included a baseline 10% tariff on all imports and “reciprocal” tariffs on dozens of countries that have trade deficits with the U.S. As of this writing, the Trump administration has suspended reciprocal tariffs for 90 days while increasing tariffs on China to 145%. Tariffs on steel and aluminum, automotives, and non-USMCA-compliant goods from Canada and Mexico remain in effect with further sectoral tariffs expected over the near-term, including semiconductor chips and pharmaceuticals. The implementation of expansive tariff policies will serve as an economic headwind moving forward, with expectations for lower growth and higher inflation for the balance of the year. The municipal sector is facing growing headwinds to finances including rising demand for local funding, evaporation of federal COVID money, and unknown impacts from tariffs on economic activity. Fortunately, municipal revenues have remained solid to this point and reserves remain strong.

Credit Markets – The first quarter’s meaningful decline in U.S. Treasury yields was driven by disappointing economic data and a subsequent increase in the number of Fed rate hikes expected in 2025. Yields traded in a tight range versus year-end 2024 levels, offering opportunities to lock in yields at attractive levels. Yield declines occurred in the second half of the quarter as economic data began to deteriorate. Q1 yield drivers became stale following the Trump administration’s “Liberation Day” tariff announcements on April 2, which sparked severe market volatility and reduced consumer and investor confidence..

Yield Curve Shift

|

U.S. Treasury Curve |

Yield Curve 12/31/2024 |

Yield Curve 3/31/2025 |

Change (bps) |

|---|---|---|---|

|

3 Month |

4.314% |

4.294% |

-2.1 |

|

1 Year |

4.143% |

4.020% |

-12.3 |

|

2 Year |

4.242% |

3.883% |

-35.8 |

|

3 Year |

4.273% |

3.874% |

-39.8 |

|

5 Year |

4.382% |

3.950% |

-43.2 |

|

10 Year |

4.569% |

4.205% |

-36.4 |

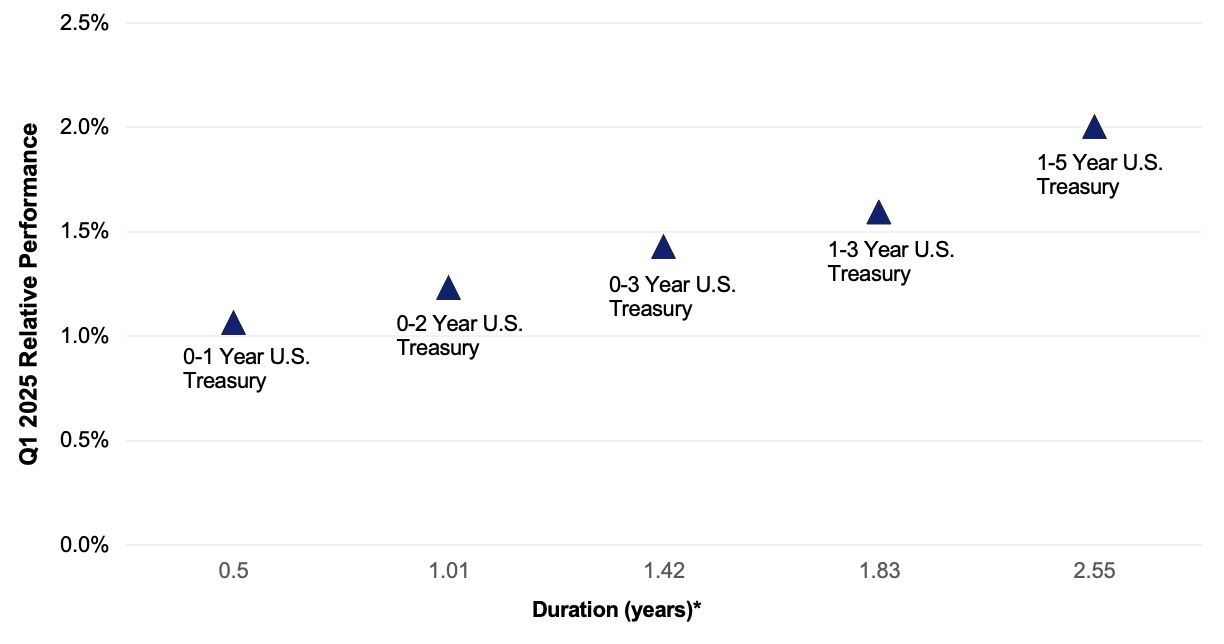

Duration Relative Performance

*Duration estimate is as of 3/31/2025

The three-month to ten-year portion of the yield curve re-inverted, as 10-year yields fell 36.4 bps with three-month yields falling only 2.1 bps on no changes to Fed rate policy in the quarter. As expected in a falling rate environment, longer duration strategies outperformed their shorter duration counterparts.

Credit Spread Changes

|

ICE BofA Index |

OAS* (bps) 12/31/2024 |

OAS* (bps) 3/31/2025 |

Change (bps) |

|---|---|---|---|

|

1-3 Year U.S. Agency Index |

4 |

3 |

-1 |

|

1-3 Year AAA U.S. Corporate and Yankees |

14 |

9 |

-5 |

|

1-3 Year AA U.S. Corporate and Yankees |

30 |

28 |

-2 |

|

1-3 Year A U.S. Corporate and Yankees |

49 |

51 |

2 |

|

1-3 Year BBB U.S. Corporate and Yankees |

75 |

80 |

5 |

|

0-3 Year AAA U.S. Fixed-Rate ABS |

38 |

50 |

12 |

Option-Adjusted Spread (OAS) measures the spread of a fixed-income instrument against the risk-free rate of return. U.S. Treasury securities generally represent the risk-free rate.

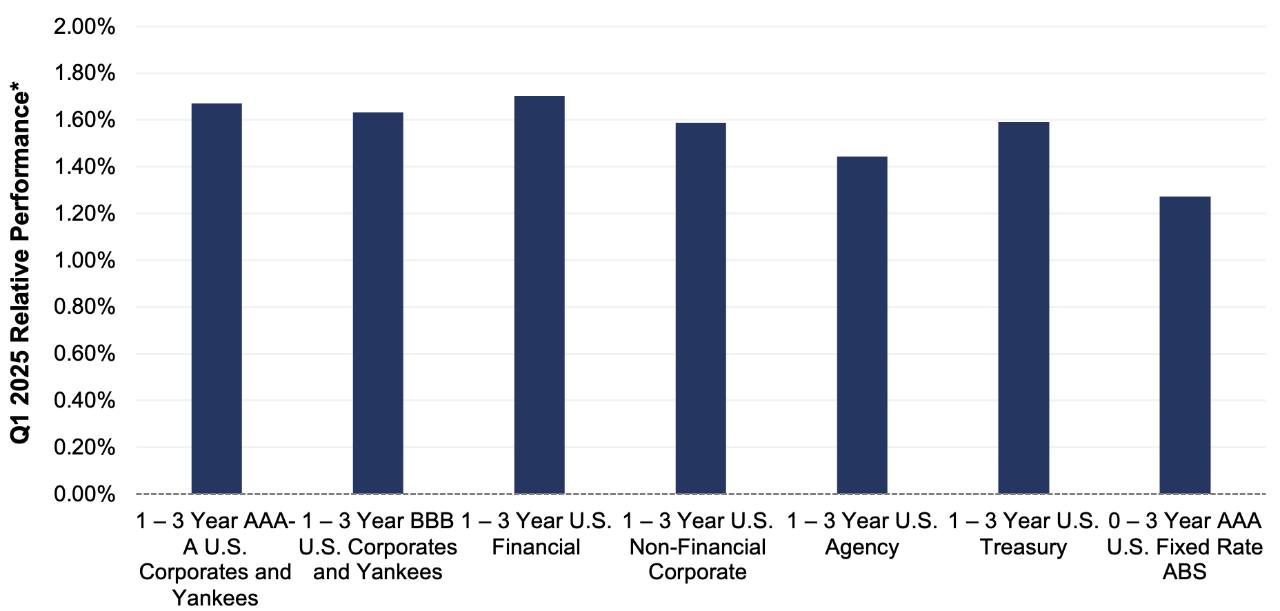

Corporate credit spreads were relatively stable in the quarter. BBB corporates underperformed their AAA-A rated counterparts as the incremental yield from BBBs could not overcome the extra widening of BBB credit spreads versus higher rated credit. Underperformance in the ABS sector was an outlier versus other spread sectors, as ABS credit spreads widened 12 bps on growing concerns over U.S. consumer health.

Credit Sector Relative Performance of ICE BofA Indexes

ICE BofA Index

*AAA-A Corporate index outperformed the Treasury index by 7.9 bps.

*AAA-A Corporate index outperformed the BBB Corporate index by 3.8 bps

*U.S. Financials outperformed U.S. Non-Financials by 11.7 bps

The sharp decline in yield curve levels generated strong absolute performance for all fixed income sectors. Given relatively uniform yield declines for two-year and longer maturities, along with mild credit spread changes in the quarter, performance dispersion among most sectors was muted. AAA-rated ABS was the outlier, as widening ABS spreads drove underperformance in the sector.

What strategic moves were made and why?

Taxable Portfolios – Driven by declines in yield curve levels, first quarter fixed income returns were strong. Investment-Grade (IG) corporate bonds posted solid relative returns as increased issuance levels were met with robust investor demand. Much of the spread widening seen during the second half of the quarter was offset by higher incremental income. From an excess return perspective, higher-quality and shorter-duration issuers outperformed in general during the quarter. Financials and banking issuers continued to lead most other industries across the yield curve during the quarter. Asset-Backed Securities (ABS) spreads widened from the impact of heavy new issuance levels and a modest deterioration of consumer credit fundamentals, particularly in the sub-prime sector. ABS spreads widened more than corporate spreads, resulting in underperformance over the quarter but better relative value going forward. There were no significant credit or rating events in the quarter, and no single issuer or position had a meaningfully positive or negative impact on portfolio performance.

Tax Exempt and Tax-Efficient Portfolios – We have previously noted the record-breaking pace of borrowing from municipalities in 2024. This momentum has carried forward into the new year, with more than $111 billion in tax-exempt issuance – the heaviest Q1 total since 2007. We attribute these sales volumes to several factors, including ongoing tax policy discussions, which may impact the municipal tax-exemption; rising project costs due to inflation; and unsustainable deficits at the federal level, which may push more costs downhill to state and local governments. The short end of the municipal curve steepened during the quarter, with one-year maturities falling 25 basis points and five-year investments declining a basis point. We were active buyers of primarily municipal bonds maturing in 2028 and 2029. Valuations were attractive versus recent municipal to Treasury yield comparisons. However, our chief motivation with these purchases was to keep portfolio durations from drifting too short relative to benchmarks. We believe this approach to duration management is prudent, given the vast uncertainties across markets and the economy.

How are you planning on positioning portfolios going forward?

Taxable Portfolios – Since the Trump administration’s tariff roll-out on April 2, market volatility has jumped, investor confidence has been shaken and business and consumer sentiment has fallen. Markets are forecasting between three and four rate cuts in 2025, while the Fed’s Dot Plot was left unchanged at two 25 bps rate cuts. We expect to see ongoing steepening of the yield curve given the expectation for future rate cuts. With the economic and Fed outlook increasingly uncertain, we are targeting portfolio duration neutral relative to benchmark duration. Investment-grade corporate bond fundamentals remain favorable while technicals have weakened on the margins. A protracted trade war and resulting hit to growth could weaken credit fundamentals. Valuations have repriced from narrow levels to reflect this uncertainty. We will selectively evaluate opportunities with a focus on industry and credit quality, with an eye toward tactically positioning portfolios to better take advantage of future opportunities. ABS fundamentals remain intact and underlying credit metrics remain solid. Consumer credit trends will depend on the labor market and the consumer’s response to monetary policy easing, which tends to work on a lag. We expect spreads to remain choppy heading into Q2 despite the stability in underlying technicals and view this as an opportunity to add allocations at more attractive levels. Government agency spreads are expected to remain at tight levels and will be underweighted in favor of U.S. treasuries for government-heavy accounts.

Tax Exempt and Tax-Efficient Portfolios – We expect to continue to position portfolios with durations near neutral - while acknowledging that, at times, municipal market supply and demand imbalances may lead us to a slightly more or less aggressive posture. Recent developments surrounding tax policy appear to be more positive toward preserving the municipal exemption – at least on a broad-based level. Education efforts of bond dealers and municipal bond advocates have been successful, and encouraged legislators to send multiple “Dear Colleague” letters of support to the Chair of the House Ways and Means committee. Further, some have argued that Congress may not have authority to eliminate the tax-exemption. These constitutional concerns, and the potential for court delays, may make other options for revenue offsets more attractive. And finally, and perhaps most helpful, is the Republican’s use of the “Current Policy” scoring baseline. This method has significantly reduced the amount of offsets required in the reconciliation bill to $1.5 trillion from near $5 trillion. Even absent any changes to the exemption, we remain mindful that municipal supply will still be a periodic headwind for the market in 2025. In the near term, April may be a challenging time as reinvestment demand is typically light. These municipal technical factors, along with our general economic outlook, will both continue to be important considerations in our overall strategies.

Sources

Bloomberg

https://www.federalreserve.gov/monetarypolicy/files/monetary20250129a1.pdf

https://www.federalreserve.gov/monetarypolicy/files/monetary20250319a1.pdf

https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20250319.pdf

https://taxfoundation.org/research/all/federal/trump-tariffs-trade-war/

https://news.bgov.com/bloomberg-government-news/bgov-bill-analysis-h-con-res-14-bicameral-budget-plan